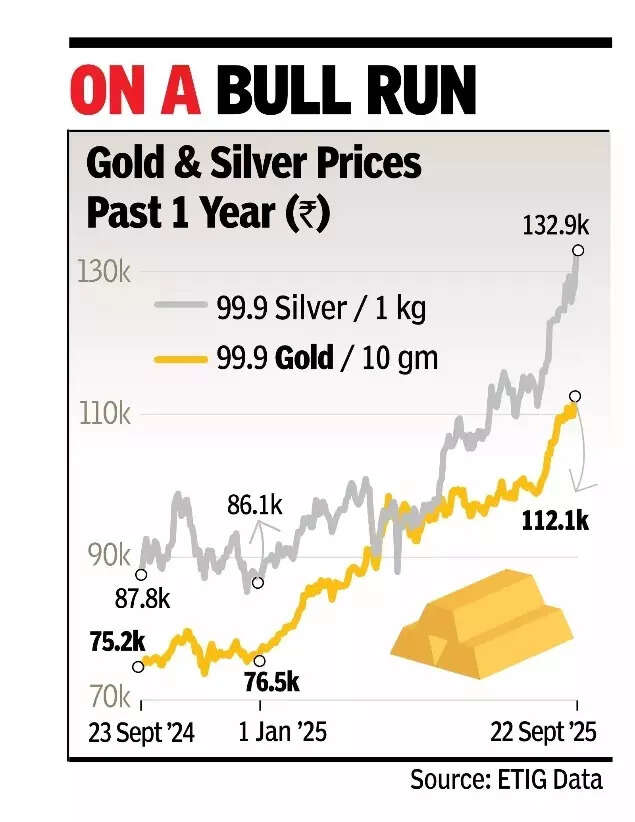

MUMBAI/ HYDERABAD: Prices of gold and silver scaled fresh all-time highs in India on Monday, as chances of lower interest rates in the US in the next few months – that in turn would mean weaker dollar – increased over the weekend. In addition, elevated geopolitical tension and tariff-induced global trade jitters supported the rally in the precious metals. Expected industrial demand for silver too boosted its price, industry experts and analysts said.In the international markets, gold traded at above the $3,750/ounce (Oz) level – a new all-time peak, and inched closer to $3,800. Silver too, rallied sharply to break above the $44/Oz mark, a new 14-year peak.Following the rallies in the international markets, combined with the weakness of the rupee, gold futures prices on MCX (Oct delivery) traded at close to the Rs 1.12 lakh/10gm mark, and silver futures prices (Dec delivery) traded at a peak of Rs 1.33 lakh/kg level, marking new all-time highs for the yellow and white metals.“The recent gold price surge to all-time high has been mostly propelled by international reasons like geopolitical tensions, trade turmoil, the effect of American tariffs, and poor labour market indicators in the US that led to the rate reduction (by the US central bank). These have added to the appeal of gold as a haven asset globally,” said Colin Shah, MD, Kama Jewelry.

Trump’s policies, including the latest one related to H1B visas, has created more confusion in minds of people towards trade tensions around the world, which in turn is forcing central banks to intensify their buying of gold, said Avinash Gupta, vice chairman, All India Gem & Jewellery Domestic Council. “Safe haven buying and central bank buying are the two key factors driving the price rise (for gold). $3,900-$4,000 is within reach now. And silver is just moving in the shadows of gold,” Gupta told TOI. “A dovish signal from the US Fed suggests that two additional rate cuts are likely by the end of this year, which could limit gains in the US dollar and treasury yields while bolstering (prices of) precious metals,” said Saumil Gandhi, senior analyst-commodities, HDFC Securities.